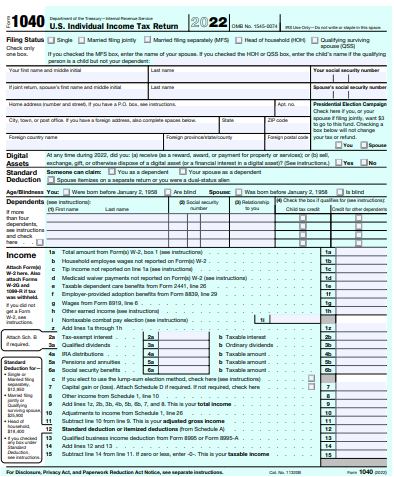

2024 Irs 1040 Schedule 4 – Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule to prepare your Schedule D for tax reporting purposes. Crypto Tax Myth #4 – If you hold . 1. Verify eligibility based on IRS requirements. 2. Calculate adjusted gross income (AGI) on Form 1040. 3. Use the student loan interest deduction worksheet to find the MAGI-specific deduction. 4. .

2024 Irs 1040 Schedule 4

Source : www.incometaxgujarat.orgPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comW4 Form 2024 | Filling out the W 4 Tax Form – Money Instructor

Source : content.moneyinstructor.com2024 Form W 4P

Source : www.irs.govIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comEmployee’s Withholding Certificate

Source : www.irs.govW 4: Guide to the 2024 Tax Withholding Form NerdWallet

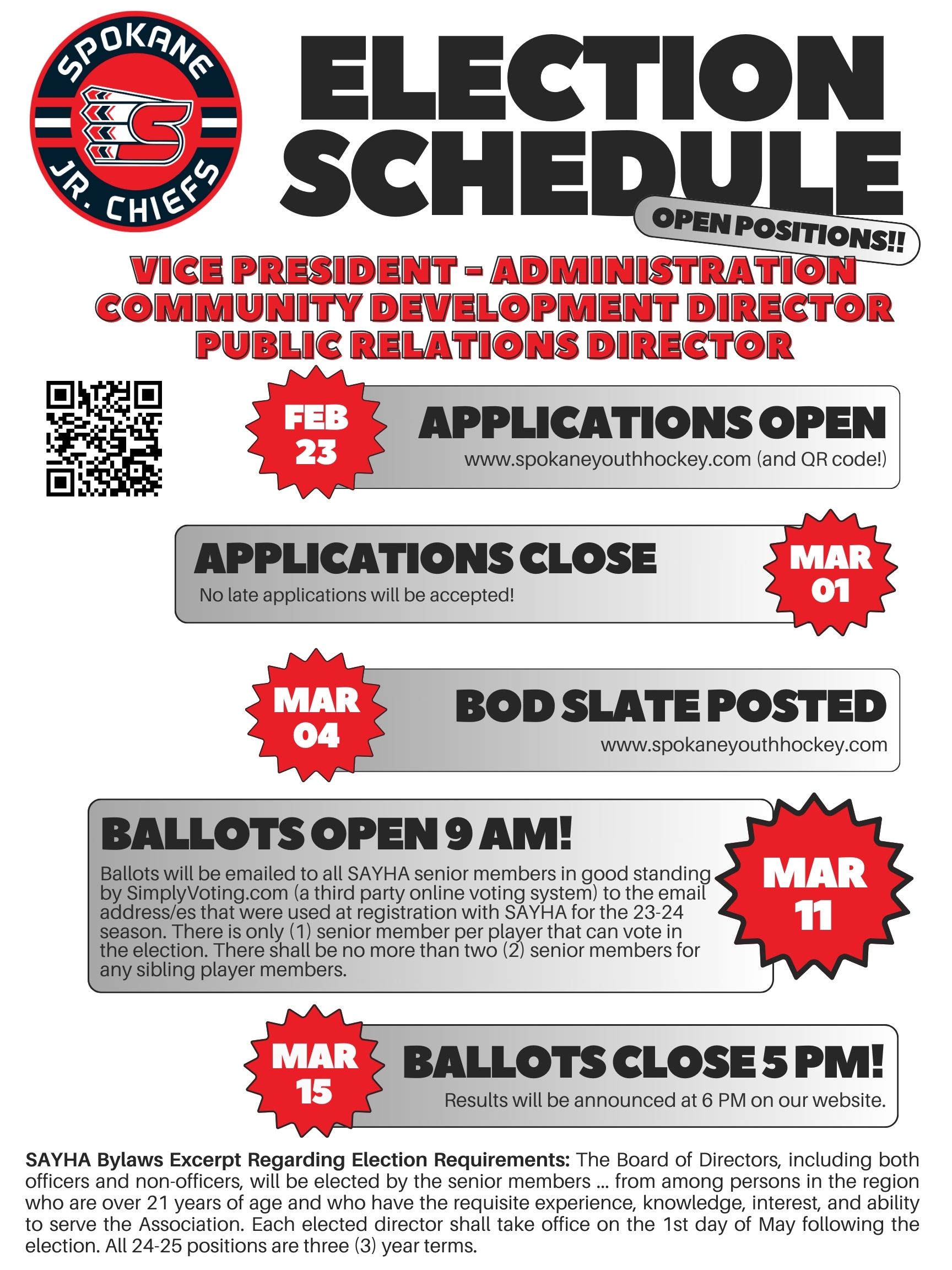

Source : www.nerdwallet.comElection 2024: Board of Directors Application Form and Election

Source : spokaneyouthhockey.comIRS Delays Implementation of 1099 K Filing Changes to Calendar

Source : taxschool.illinois.edu2024 Irs 1040 Schedule 4 Form 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions : Every dollar you win from gambling should be reported to the IRS, otherwise you could be fined or even go to jail. . If you earn less than $600 in a tax Schedule C. Include your gross sales on Line 1, the value of any returns and allowances on Line 2 and your cost of goods sold — from Part III — on Line 4. .

]]>