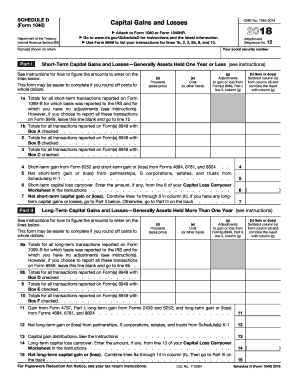

Schedule D Worksheet 2024 Form 1040 – If your business sold any capital assets, profitable or not, you will have to report it to the IRS using Schedule D complete this worksheet, you will need to complete Form 1040 through . Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms. Whenever you sell a capital asset held for personal use at a gain, you need to calculate how much money .

Schedule D Worksheet 2024 Form 1040

Source : www.irs.govForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.org1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.comFiling taxes for your restricted stock, restricted stock units, or

Source : workplaceservices.fidelity.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comSchedule D Tax Worksheet walkthrough YouTube

Source : www.youtube.com1040 (2023) | Internal Revenue Service

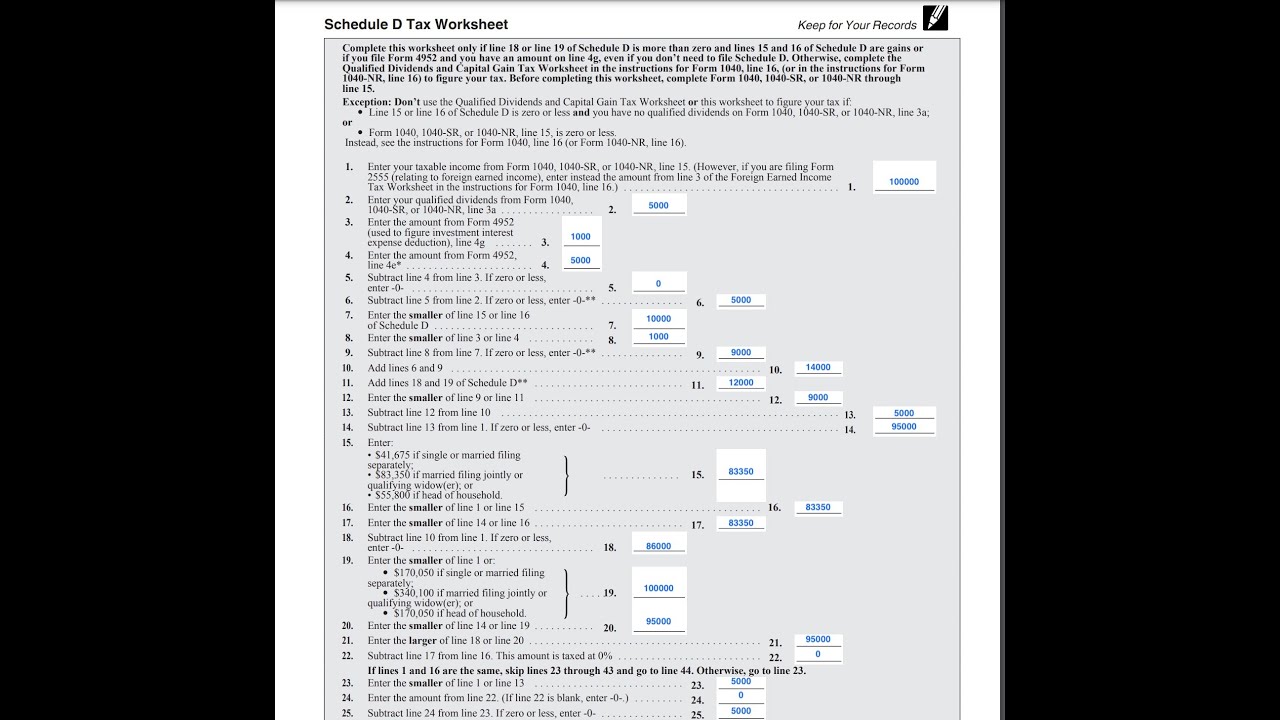

Source : www.irs.govSchedule D Worksheet 2024 Form 1040 1040 (2023) | Internal Revenue Service: you’re directed to the separate Qualified Dividends and Capital Gain Tax worksheet or the Schedule D Tax worksheet, which are found in the Form 1040 instructions booklet. These worksheets take you . Key Takeaways – How to Claim Your Student Loan Payments on Your 2023 Taxes After a three-year pandemic pause, federal student loan payments resumed for more than 28 million borrowers in October 2023, .

]]>